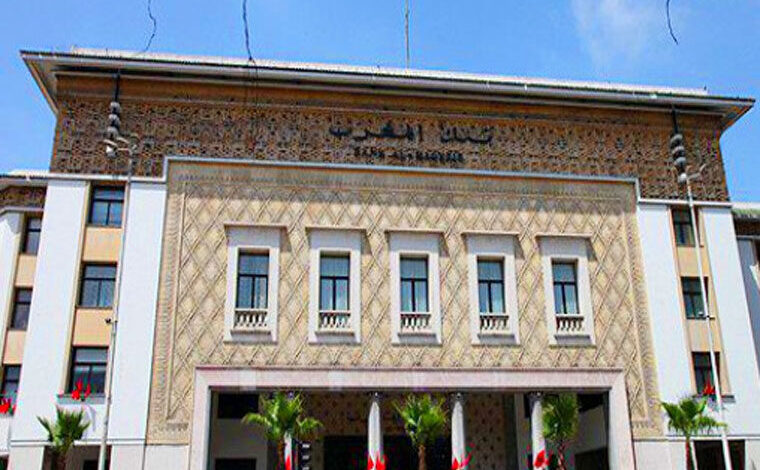

BAM Maintains Its Key Rate Steady at 2.25%

Bank Al-Maghrib Council Maintains Key Rate at 2.25%

The Council of Bank Al-Maghrib (BAM), convened on Tuesday in Rabat, has decided to keep the key interest rate unchanged at 2.25%.

“In light of the continuing low inflation levels and the still high degree of uncertainty, particularly with ongoing geopolitical tensions globally and domestic climatic conditions, the Council has resolved to maintain the key rate at 2.25%,” BAM stated in a press release following its fourth quarterly meeting of 2025.

The Council will continue to closely monitor economic developments and will base its decisions from one meeting to the next on the most up-to-date data available.

During this session, the Council commended the commitment of various stakeholders who signed the Charter concerning the financing and support for very small enterprises (VSEs). This initiative is expected to make a significant contribution to the development of this category of businesses, enhancing their participation in investment, job creation, and the promotion of integrated territorial development.

The Council then assessed the current economic situation along with BAM’s medium-term macroeconomic forecasts.

On the international front, it noted a slight easing of trade tensions and the conclusion of the U.S. budget impasse; however, the level of uncertainty remains elevated, particularly concerning changes in U.S. tariff policies and persistent geopolitical conflicts.

In this context, despite relative resilience in the first half of the year, driven by anticipatory effects of tariff increases, the global economy is expected to continue slowing down, with improvements forecasted only by 2027. Inflation is projected to decelerate further before accelerating again in 2027, with heterogeneous developments across different economies.

Nationally, the Council highlighted the remarkable performance of non-agricultural activities and signs of recovery in the labor market, as stated in the release.

This dynamic is expected to continue in the medium term, supported by increased investment efforts. It also reviewed the figures from the 2026 Finance Law (LF 2026) and the 2026-2028 Triennial Budget Programming, which indicate a continued consolidation of the budget and a gradual reduction in government debt.

Regarding inflation, it continues to remain low, averaging 0.8% over the first ten months of 2025. This is attributed mainly to improvements in the availability of certain food products, especially olive oil, and decreases in fuel and lubricant prices.

According to projections from the central bank, inflation is expected to gradually accelerate to align with the price stability objective. Thus, following a projected rate of 0.8% for the entirety of this year, it is anticipated to rise to 1.3% in 2026 and then to 1.9% in 2027.

The underlying inflation component is expected to be at 0.7% this year and next, before accelerating to 1.9% in 2027. Inflation expectations remain firmly anchored.

Financial sector experts surveyed for Bank Al-Maghrib’s quarterly report predict an average inflation rate of 2% in the fourth quarter of 2025 over an eight-quarter horizon, and 2.2% over a twelve-quarter horizon.

On the transmission of previous Council decisions, a partial decline in lending rates associated with bank credits to the non-financial sector persists, with a cumulative reduction since the initiation of monetary easing in June 2024, showing a decrease of 58 basis points (bp) by the third quarter of 2025, compared to a 75 bp reduction for the key rate.

Nationally, economic growth is projected to accelerate notably to 5% this year, consolidating at an average of 4.5% over the next two years.

Indeed, after a 5% rise in 2025, the agricultural value added is expected to increase by 4% in 2026 and 2% in 2027, assuming a return to average cereal harvests of 50 million quintals.

In non-agricultural sectors, growth is anticipated to remain robust, particularly driven by strong investment dynamics, projected at 5% this year, 4.8% in 2026, and 4.5% in 2027.

Regarding external trade, exports are expected to rise by 4.5% in 2025, supported by improved sales of phosphate and derivatives valued at 108 billion dirhams (billion MAD), followed by increases of 8.4% in 2026 and 7.9% in 2027, closely linked to the expected recovery in the automotive industry’s shipments.

These shipments, after experiencing a contraction this year, are projected to grow annually at around 17%, reaching 208 billion MAD by 2027.

Concurrently, the pace of imports is expected to remain strong, primarily driven by acquisitions of capital goods and consumer goods, while the energy bill is anticipated to decrease further in 2025 and 2026, before rising to 101 billion MAD in 2027.

Tourism receipts are expected to maintain their notable performance, approaching nearly 155 billion MAD by 2027.

As for remittances from Moroccans living abroad (MRE), they are projected to grow by an average annual rate of 3.1% between 2025 and 2027, reaching 130 billion MAD. Overall, the current account deficit is expected to remain contained at 1.8% of GDP in 2025 and below 2% in the following two years.

Likewise, foreign direct investment flows are expected to strengthen, with annual receipts amounting to 3.5% of GDP.

Considering the anticipated external financing for the Treasury, Bank Al-Maghrib’s official reserve assets are expected to gradually strengthen, reaching 448 billion MAD by the end of 2027, ensuring a coverage of nearly 5.5 months of imports of goods and services.

In terms of monetary conditions, the banking liquidity needs are projected to widen gradually, reaching 158 billion MAD in 2027, primarily linked to the anticipated increase in currency circulation.

Regarding the credit extended to the non-financial sector, and considering the expected evolution of economic activity and banking system projections, its growth rate is expected to accelerate to 4.1% in 2025, and to 5% in both 2026 and 2027.

With respect to the dirham’s value, quarterly evaluations conducted by BAM, following the latest internationally adopted methodology, indicate that it remains broadly aligned with economic fundamentals.

The effective exchange rate is expected to appreciate by 2.2% in real terms in 2025, reflecting an increase in its nominal value, tempered by a lower domestic inflation rate compared to that of partner and competitor countries. It is then expected to depreciate by 2.8% in 2026 and 0.5% in 2027.

Regarding public finances, taking into account budget execution as of late October, data from the 2026 Finance Law, and the 2026-2028 Triennial Budget Programming, the central bank’s projections highlight a continuation of medium-term budget consolidation.

The deficit excluding revenue from the disposal of state holdings is expected to decrease from 3.9% of GDP in 2024 to 3.6% in 2025, and then to 3.4% in both 2026 and 2027.

Finally, the Council validated the foreign exchange reserve management strategy, approved the bank’s budget, and the internal audit program for the fiscal year 2026. It also set the dates for its regular meetings for that year: March 17, June 23, September 22, and December 15.